- Crypto Profit 101

- Posts

- Whale Deposits: What a $21M Exchange Move Means for You This June

Whale Deposits: What a $21M Exchange Move Means for You This June

And Which Are The 4 Coins Deposited?

Have you ever wondered how big players in the crypto world can affect the market with just one move? Imagine a $21 million transaction in DeFi tokens – that’s what happened recently and it might be a big deal for your investments.

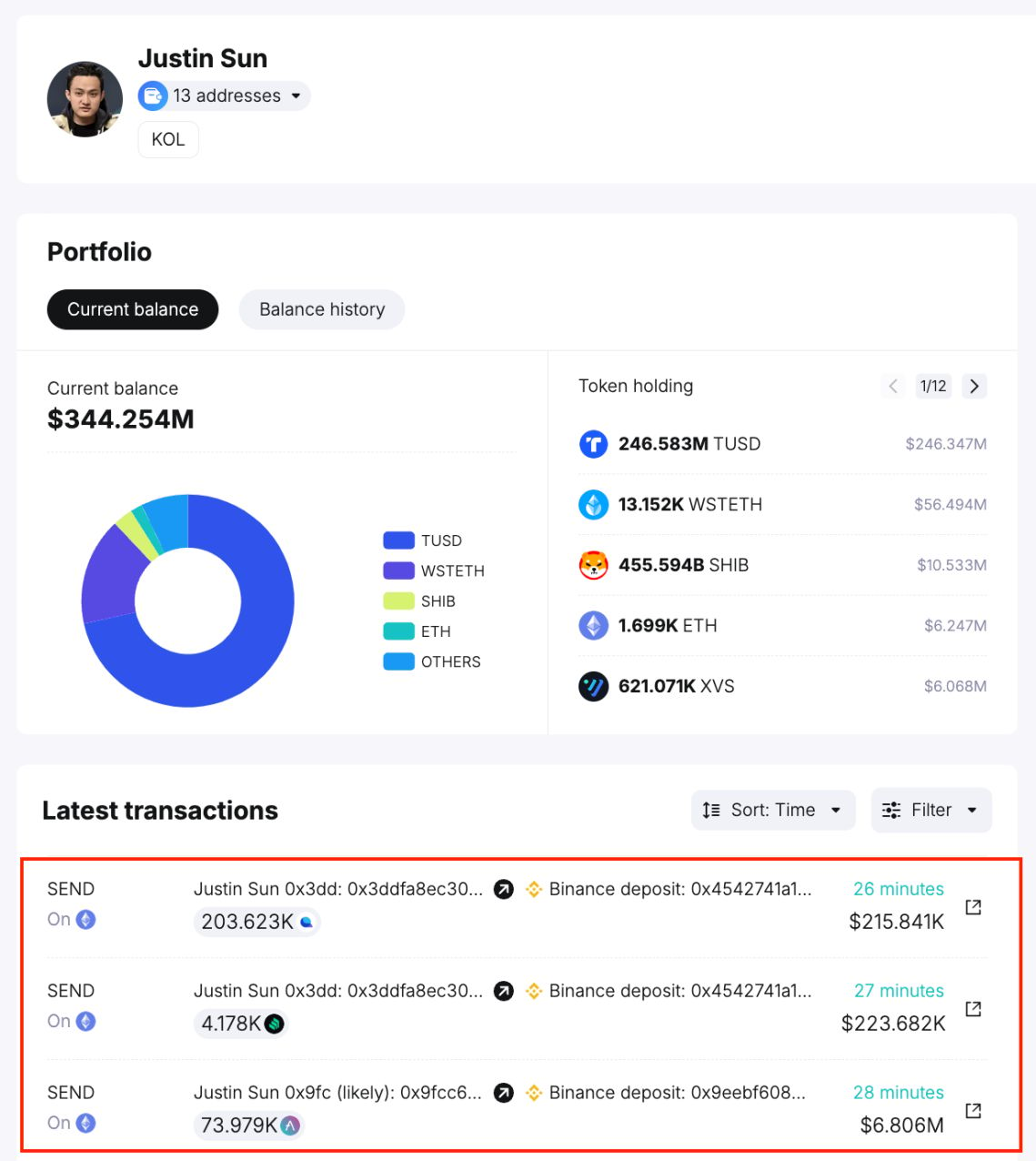

Sun deposits AAVE, COMP, and LQTY to Binance. Source: Spotonchain

A dormant whale recently moved $21 million worth of DeFi token to Binance. On-chain analysis suggests that Tron founder Justin Sun could be behind this transaction. Despite this large move, token prices didn’t change much, making many wonder about the market impact.

In this article, I’ll explain what a large deposit into an exchange means using this $21 million transaction as an example. By the end, you'll know how such moves affect the market so that you can make smarter decisions with your crypto investments.

1. What Does This News Mean to Crypto Investors?

When a big player, or whale, moves a large amount of cryptocurrency into an exchange, it can mean a few things. They might be planning to sell, which could drive prices down. Or, it might just mean there’s more liquidity, which can be good for the market.

Why Did This Happen?

Getting Ready For Big Movement

Whales often move funds to exchanges so that they can react quickly, especially if they’re looking to sell. For example, during the 2021 bull run, several whales moved large amounts of Bitcoin to exchanges, expecting prices to peak. In December 2021, Bitcoin reserves on exchanges increased by 42,900 BTC, indicating possible sell-offs. And guess what happened after Dec 2021? Just look at this chart below

Bitcoin price chart from 2020 to 2023. Source: tradingview

Potential Market Influence

Large token movements can influence market sentiment. Traders watch whale activities closely, as such moves can signal potential price changes. In 2017, a whale moved $400 million worth of Bitcoin to exchanges, leading to a 30% price drop within days.

Preparation for Market Events

Whales might move tokens in anticipation of events like forks, major announcements, or regulatory changes. Before Ethereum 2.0's launch in 2020, notable whale movements were seen as they prepared for staking and liquidity provision. In November 2020, whale deposits to exchanges spiked by 18% ahead of Ethereum’s transition.

2. Breaking Down the 4 Coins Involved

Maker (MKR)

Maker price chart in 2024. Source: tradingview

Maker is a governance token for the MakerDAO and Maker Protocol. It helps stabilize the value of the DAI stablecoin. As of 2023, Maker’s market cap was around $1.5 billion, showing its important role in DeFi.

Aave (AAVE)

Aave price chart in 2024. Source: tradingview

Aave is a DeFi protocol that lets people lend and borrow crypto. Lenders earn interest by depositing digital assets into liquidity pools. In 2023, Aave had over $4 billion in total value locked (TVL), making it one of the top DeFi platforms.

Compound (COMP)

Compound price chart in 2024. Source: tradingview

Compound is a DeFi protocol that allows users to earn interest on their crypto holdings or borrow against them. It’s known for decentralized governance via the COMP token. In 2023, Compound had a TVL of about $2.7 billion, indicating its strong market presence.

Liquity (LQTY)

Liquity price chart in 2024. Source: tradingview

Liquity is a decentralized borrowing protocol that allows drawing interest-free loans against Ethereum used as collateral. Its unique interest-free feature makes it attractive. By late 2023, Liquity had a TVL exceeding $600 million, showing its growing use.

3. How This News Can Affect Your Investment Portfolio

Large whale movements can signal upcoming market volatility. For beginner investors, this could mean potential buying opportunities or a need to be cautious. Watching these activities can help you make timely decisions.

3 Wise Actions to Take Next

Subscribe to Crypto Profit 101 Newsletter: Stay updated with the latest market trends and expert insights to navigate the crypto market confidently.

Monitor Whale Activities: Use tools and platforms that track whale movements. Understanding these trends can give you an edge in predicting market shifts.

Get Ready For Your Next Move: If you’re bearish, get ready to short the crypto. If you’re bullish, get ready your entry points with your limit orders.

Your journey in crypto investing is just beginning. Stay informed, stay strategic, and watch your investments grow.

Final Thought: The crypto market is always changing and often unpredictable. By staying informed and understanding the significance of whale activities, you can navigate these waters more confidently. Remember, in the world of crypto, knowledge and timely actions are your best tools.

Thank you for reading. If you have any thoughts or questions, feel free to share them with us!

Reply