- Crypto Profit 101

- Posts

- The 1 Metric You Can’t Afford to Ignore in 2024

The 1 Metric You Can’t Afford to Ignore in 2024

Why Smart Investors Are Watching Bitcoin Dominance Like Hawks

I remember the first time I ventured into the crypto market—it was overwhelming.

Numbers flying everywhere, charts spiking up and down, and a sea of jargon that left me confused.

One term that kept popping up was "Bitcoin dominance," but I didn’t understand its significance until I missed out on a major opportunity.

After some hard lessons, I learned just how critical this metric is, and I want to share that with you so you can avoid the mistakes I made.

Stick with me until the end, and you'll discover how mastering this one metric could significantly boost your investment strategy in 2024.

Why The Urgency To Know This Now?

Recently, crypto analysts have been sharing their thoughts on Bitcoin dominance.

Benjamin Cowen believes Bitcoin's dominance won’t hit the 70% level it once did but could peak at around 60% by late 2024.

Another analyst, Kaleo, suggests that Bitcoin’s dominance might have already reached its high point, hinting that we could be entering an altcoin season where other cryptocurrencies start to shine.

What is Bitcoin Dominance and Why It Matters

So, what exactly is Bitcoin dominance?

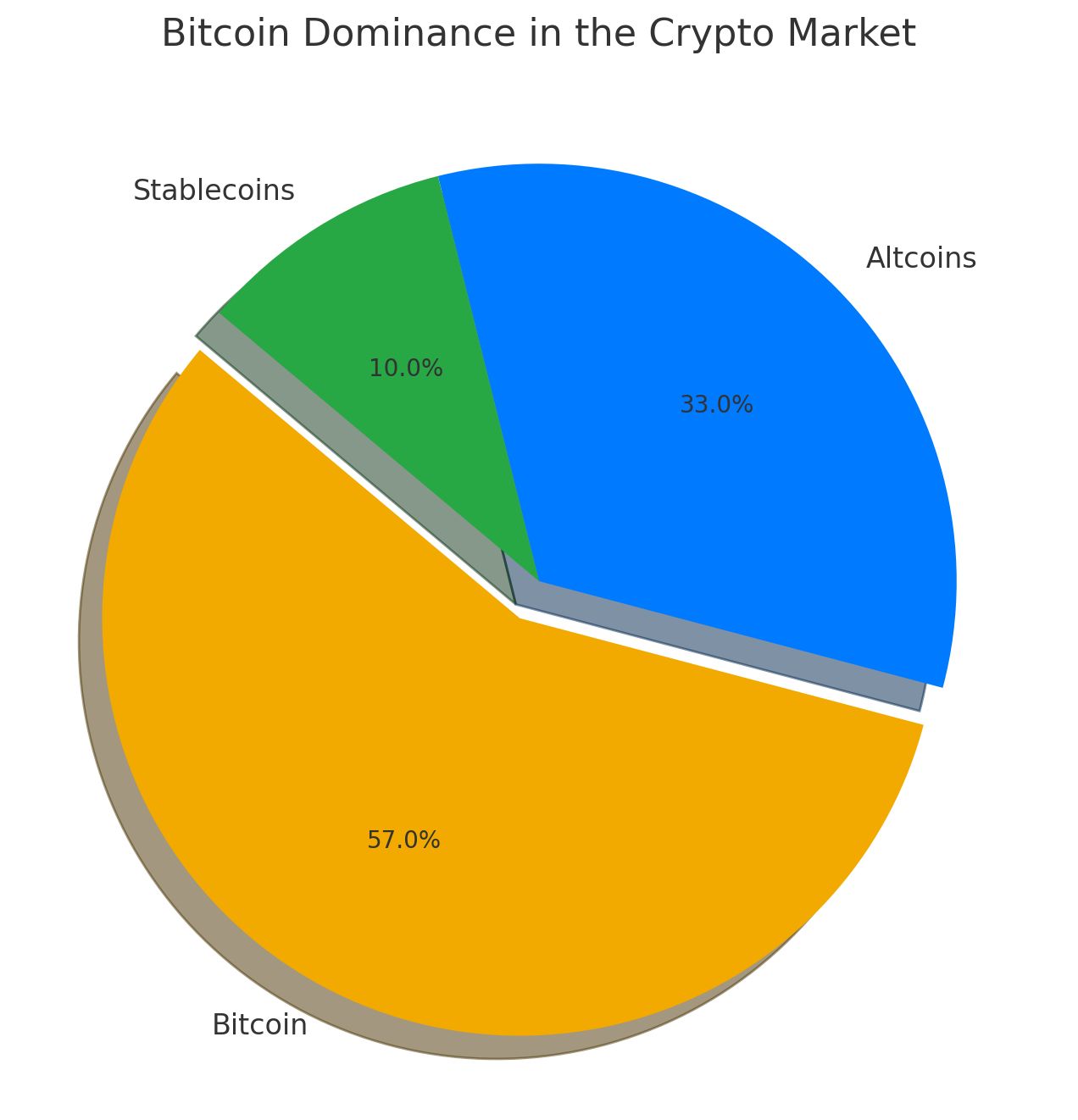

It’s a measure of how much of the entire cryptocurrency market is made up of Bitcoin.

Picture the crypto market as a giant pie, with Bitcoin’s slice representing its dominance.

And why should this matter to you?

High Bitcoin dominance usually signals that investors are playing it safe by sticking with Bitcoin.

But when dominance drops, it often means they’re venturing into other cryptocurrencies, potentially leading to significant gains in those altcoins.

Why Bitcoin Dominance Can Make or Break Your Crypto Profits in 2024

To understand why Bitcoin dominance matters, let’s revisit the 2021 altcoin season.

Back then, Bitcoin’s dominance dropped from 70% to below 40%, and in that window, altcoins like Ethereum and Solana skyrocketed.

Ethereum, for example, significantly outperformed Bitcoin. As Bitcoin's dominance fell, Ethereum’s market share and price surged from $730 to over $4,000 in just five months!

Investors who shifted some of their focus from Bitcoin to Ethereum reaped substantial rewards.

Monitoring Bitcoin dominance during this period was key—those who did were able to capitalize on altcoin opportunities and maximize their profits.

What History Is Telling Us

Bitcoin Dominance History: Historically, Bitcoin dominance has ranged from over 90% in crypto’s early days to as low as 35% during peak altcoin seasons.

Market Cap Correlation: When Bitcoin dominance decreases, the total crypto market cap often increases, driven by gains in altcoins.

These insights show that Bitcoin dominance is more than just a number; it’s a powerful indicator that can help you navigate the market and make smarter investment choices.

Speaking of smart decisions, if you’re looking to invest in crypto but want an easier way to manage it, Betterment now offers crypto portfolios.

They handle the complexities of crypto investing for you, so you can focus on making informed choices—like the ones we’ve discussed today.

Plus, Betterment provides personalized financial advice and automatic rebalancing, ensuring your investments stay aligned with your goals.

It’s worth checking out, especially if you’re serious about growing your investments. Don’t miss out on this opportunity to make your money work harder for you in the crypto space.

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

What Should a Investor Do Next?

Now that you know about Bitcoin dominance, here’s what you should do: keep an eye on this metric.

If you see it rising, consider focusing more on Bitcoin.

If it’s falling, it might be time to explore altcoins.

You can track Bitcoin dominance on popular websites like TradingView.

By staying informed, you’ll be better positioned to make smart, profitable decisions in this dynamic market.

Stay Ahead with Crypto Profit 101

If you found this article valuable and want to keep learning how to navigate the crypto market effectively, subscribe to our newsletter Crypto Profit 101.

We break down the latest crypto news and trends into simple, actionable insights, so you can make informed decisions and stay ahead of the game. Don’t miss out—subscribe today!

Reply