- Crypto Profit 101

- Posts

- Do This Before Big Banks Start Buying Up This Crypto

Do This Before Big Banks Start Buying Up This Crypto

This Investment Move That Could Triple Your Wallet

Hey there! Have you heard? Over $3 billion worth of Ethereum just left exchanges after the U.S. approved Ethereum ETFs. This big move suggests a potential supply squeeze that could drive Ethereum’s prices sky-high. Let me break down what this means and how you can take advantage of it to potentially boost your investment returns.

1. Crypto exchanges see $3B Ethereum exit since ETF approvals

Ethereum ETFs are now a thing, and this has made a lot of Ethereum move off trading platforms into wallets and such, making it less available. Just like anything rare, it could become more valuable, which means the price might go up. Understanding this can help you make smarter investment choices.

By the end of this read, you’ll understand how this big news about Ethereum can help you make better investment choices so that you might boost your profits.

2. Why Should You Care About Ethereum ETFs?

As your go-to crypto guide, let’s dig into why Ethereum ETFs are a big deal. Remember in early November 2020 when Bitcoin ETFs got approved, and Bitcoin’s price soared by about 21% in just a week? We might see Ethereum follow this path, which could mean a great opportunity if you’re looking to invest.

Understanding Supply and Demand

Think of Ethereum like the last slice of your favorite pizza—when there's less available, everyone wants it more, and it becomes more valuable. With less Ethereum available on exchanges, its price might just go up. This happened with Bitcoin from January to August 2021 too; when its availability on exchanges dropped by 20%, its price went up by over 55%. This correlation between supply scarcity and price increase is a vital indicator of potential market trends for Ethereum.

What’s Driving This Change?

Institutional Investors: Just like when more schools started accepting a new exam, making it more popular, Ethereum getting an ETF means big-time investors see it as a good choice, which can make it more stable and trustworthy.

Investor Trends: After Bitcoin ETFs started, lots of big investors jumped in. We’re expecting the same with Ethereum, making it potentially a safer and more profitable investment choice.

Market Reactions: Initially, prices might jump around because everyone’s excited or nervous. But over time, like Bitcoin, the prices might reflect more of Ethereum’s true value rather than just hype.

3. Resources and Sponsors

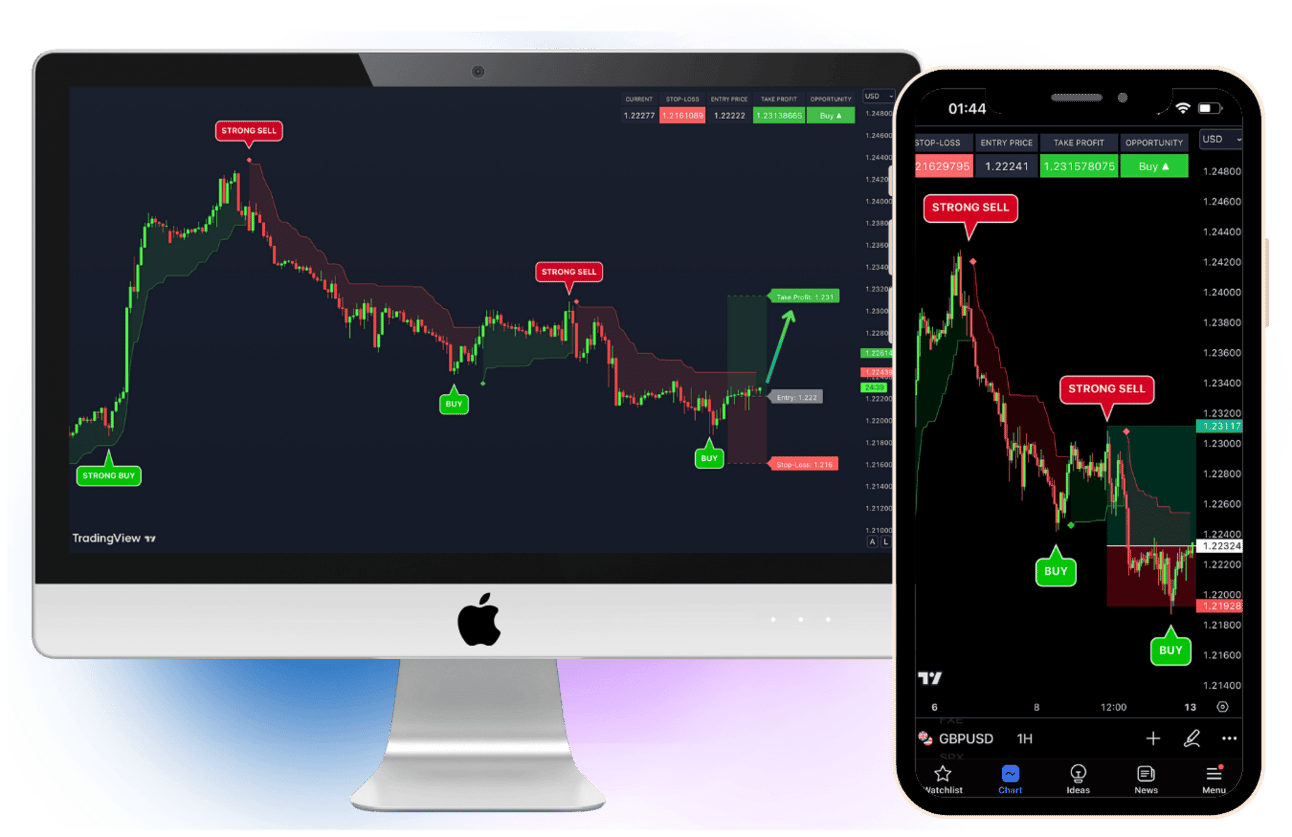

Are you like me, always confused or a little short of confidence when you’re ready to place your trade order?

This happens to me a lot, especially when I am starting out in my investing journey. You can try out this indicator that I personally use. It is simple to use and cheap. Most importantly, it gives me very reliable and consistent signals. They claimed up to 93% accuracy and while I dont track it myself, it feels close to my experience.

No more guesswork. No more endless hours of market analysis and I hope this can help you get started or improve your game.

After you have tried it, let me know how it works for you too.

4. Conclusion: Take Action and Benefit Now

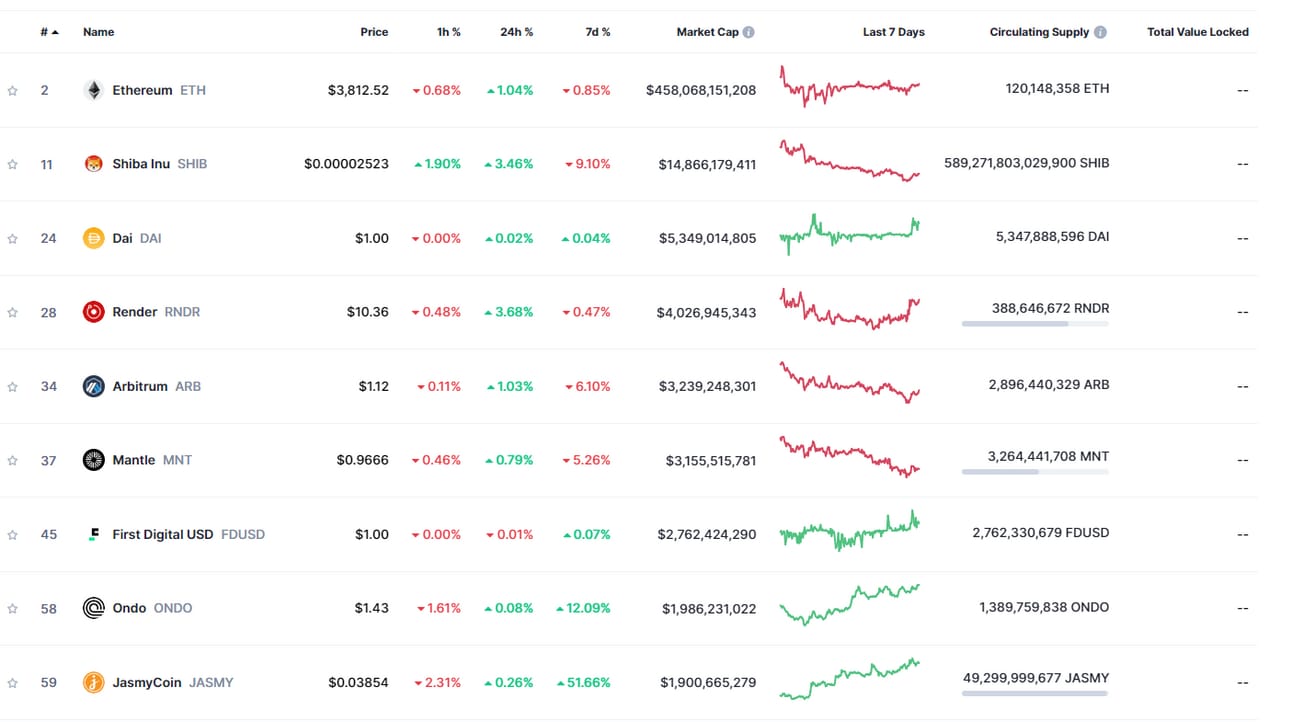

Top 9 crypto by market cap in Ethereum Ecosystem. This is a good source to start looking for good crypto to buy. Source: coinmarketcap

Ethereum’s new ETF status could change the game for your investment portfolio. With Ethereum becoming scarcer on exchanges, we might see its price go up, making now a potentially lucrative time to rethink your investment strategies.

What You Can Do Next

Stay Updated: Subscribe to the Crypto Profit 101 newsletter to keep up with the latest tips and market insights.

Keep an Eye on the Market: Watch how Ethereum’s price and market behavior change. This can tell you a lot about the momentum and when might be a good time to make your move. This is where your technical analysis comes into play. If you need help with a little guidance, you can get the indicator here.

Diversify Wisely: While Ethereum looks promising, mixing it up with other altcoins that uses Ethereum network like Ondo, Render or Arbitrum can help balance your risks and increase your chances for gains.

Now’s the time to get active, not just to protect your investments but to grow them. Dive into the evolving crypto market, use what you’ve learned here, and make choices that could seriously boost your portfolio. Why sit back? Start making those smart moves today and be ready for the exciting shifts in the crypto world.

Reply