- Crypto Profit 101

- Posts

- Bitcoin Is Now a Coiled Spring—And It’s About to Explode

Bitcoin Is Now a Coiled Spring—And It’s About to Explode

Volatility is at historic lows, weak hands are getting wrecked, and the next big move is about to catch everyone off guard—will you be ready?

Alright, let’s be real. Bitcoin has been stuck in this godforsaken price range for 81 days now—a mind-numbing, soul-crushing, patience-testing stretch of absolute NOTHINGNESS.

No moon mission.

No crash.

Just a slow, torturous grind between $91,000 and $102,000 while traders stare at their screens wondering if they should take up gardening instead.

But let me tell you something.

This is EXACTLY how the market traps people before a monster move.

Before we explain why, if you’re enjoying this piece of content or found it useful, a quick click on our sponsor’s ad below helps keep us going. Appreciate the support!

Want to stay ahead like the big players?

Take a look at this—it’s one of the easiest ways to get into crypto without all the hassle.

No wallets, no complicated exchanges, just exposure to 60+ cryptocurrencies in a single stock.

I checked it out, and honestly, it makes a lot of sense.

Give it a look and see if it’s right for you. Link’s below!

Diversified Crypto in One Stock – 60+ cryptocurrencies, one investment.

Gain exposure to 60+ cryptocurrencies in a single stock. DeFi Technologies (CBOE: DEFI OTC: DEFTF) offers broad access to the $3T crypto market—without the complexity of wallets or exchanges.

Bitcoin Is a Coiled Spring Ready to Snap

Here’s what the data is screaming:

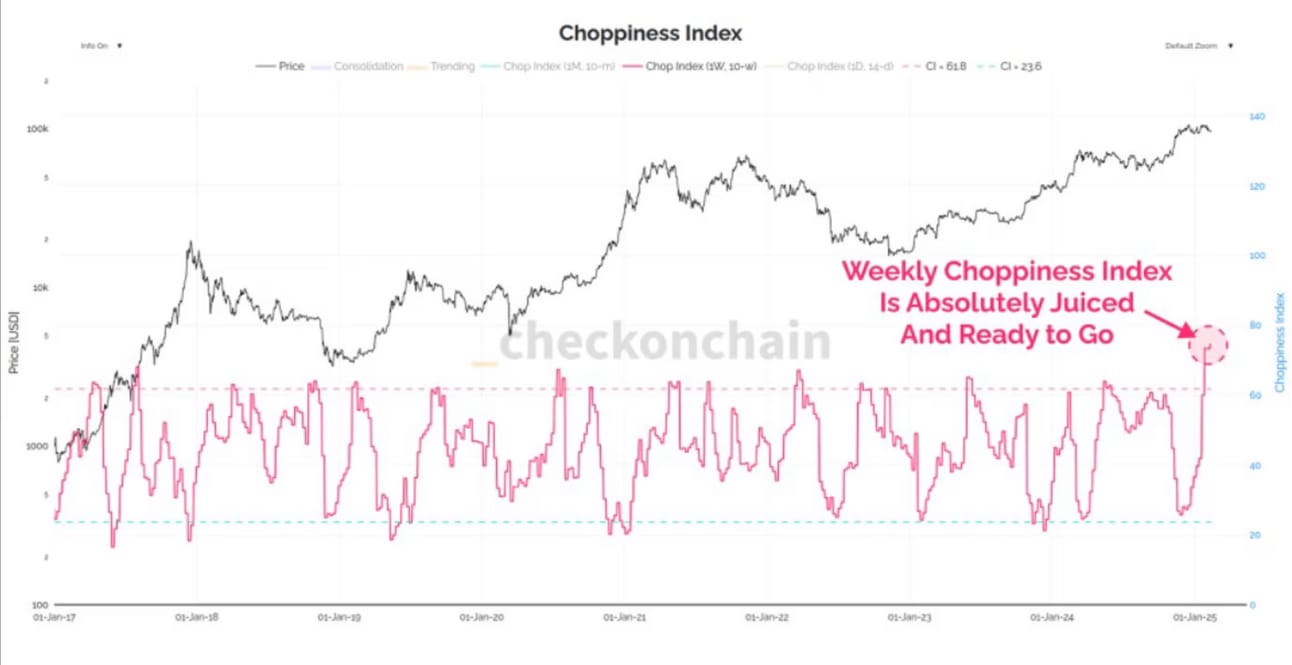

Two-week realized volatility has dropped to a pathetic 32%, one of its lowest readings in YEARS.

One-month options-implied volatility? Below 50%.

Choppiness Index? Highest since 2015.

Choppiness Index. Source: Checkonchain

For those of you who don’t speak "on-chain analytics," let me translate: Bitcoin is wound up tighter than a rubber band about to snap.

The last time we saw this level of boredom, BTC erupted.

And I don’t mean a little push—I mean a full-blown, slap-your-grandma kind of breakout.

Short-Term Traders Are Getting SLAUGHTERED

If you’ve been panic-selling during this sideways chop, I’ve got some bad news: you’re the exit liquidity for institutions right now.

Short-term holders have already bled out $520 million in realized losses—the kind of money that funds an entire fleet of Lambos.

But guess who’s NOT selling?

The big boys. The long-term holders. The ones who know how the game is played.

You think institutions don’t know exactly what they’re doing?

They’ve got an army of quants and analysts making moves while retail traders are out here staring at TikTok "crypto gurus" for guidance.

Altcoins Are Getting Murdered (And That’s a HUGE Signal)

Meanwhile, the altcoin market is an absolute bloodbath.

Meme coins like PEPE?

-46.4% in a month.

That’s half your portfolio VANISHING if you went all-in on frog tokens.

And if you’ve been in this game long enough, you know what this means.

Altcoins bleeding while Bitcoin holds steady is one of the biggest telltale signs of a BTC breakout.

Retail traders are panic-dumping their garbage bags while whales are quietly stacking Bitcoin like it's on Black Friday discount.

The Trigger? One Big Macro Catalyst.

The big question everyone’s asking: What’s going to set this thing off?

Some people are watching inflation data, others are waiting for Jerome Powell to sneeze in the wrong direction.

But here’s a big one to keep your eyes on: Abu Dhabi just threw money into BlackRock’s Bitcoin ETF.

Read that again. ABU DHABI. BLACKROCK. BITCOIN.

If that’s not a bullish trifecta, I don’t know what is. While retail traders hesitate, the world’s biggest players are positioning themselves before the rocket takes off.

First Bitcoin, Now Smartphones—The Next Big Disruption is Here

Honestly, this got me thinking—we pay so much for our phones, but what if they actually paid us back?

Sounds kinda wild, right?

But that’s exactly what Mode Mobile is doing.

I just came across it, and it’s actually pretty interesting.

Take a look and see what you think—might be worth checking out. Link’s below!

The smartphone story isn’t over yet…

Uber did it to taxis, Airbnb to hotels, & now Mode is doing it to the $500B smartphone industry.

They’ve turned smartphones from an expense into an income stream - don’t miss your chance to invest.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

You’re Either in Position—Or You’re Left Behind

I’ve seen this game play out before.

Bitcoin doesn’t stay boring forever.

When it finally breaks out, it’s going to be FAST.

And if you’re still "thinking about it" when that happens, you’ll be the one buying the top from the same institutions that have been accumulating for months.

So here’s your wake-up call.

Are you positioned for what’s coming?

Or are you going to watch from the sidelines, FOMO in at $120K, and cry when it corrects?

Your move.

Make sure you’re subscribed to Crypto Profit 101—because in this market, you either stay ahead… or get left behind. 🚀

Reply