- Crypto Profit 101

- Posts

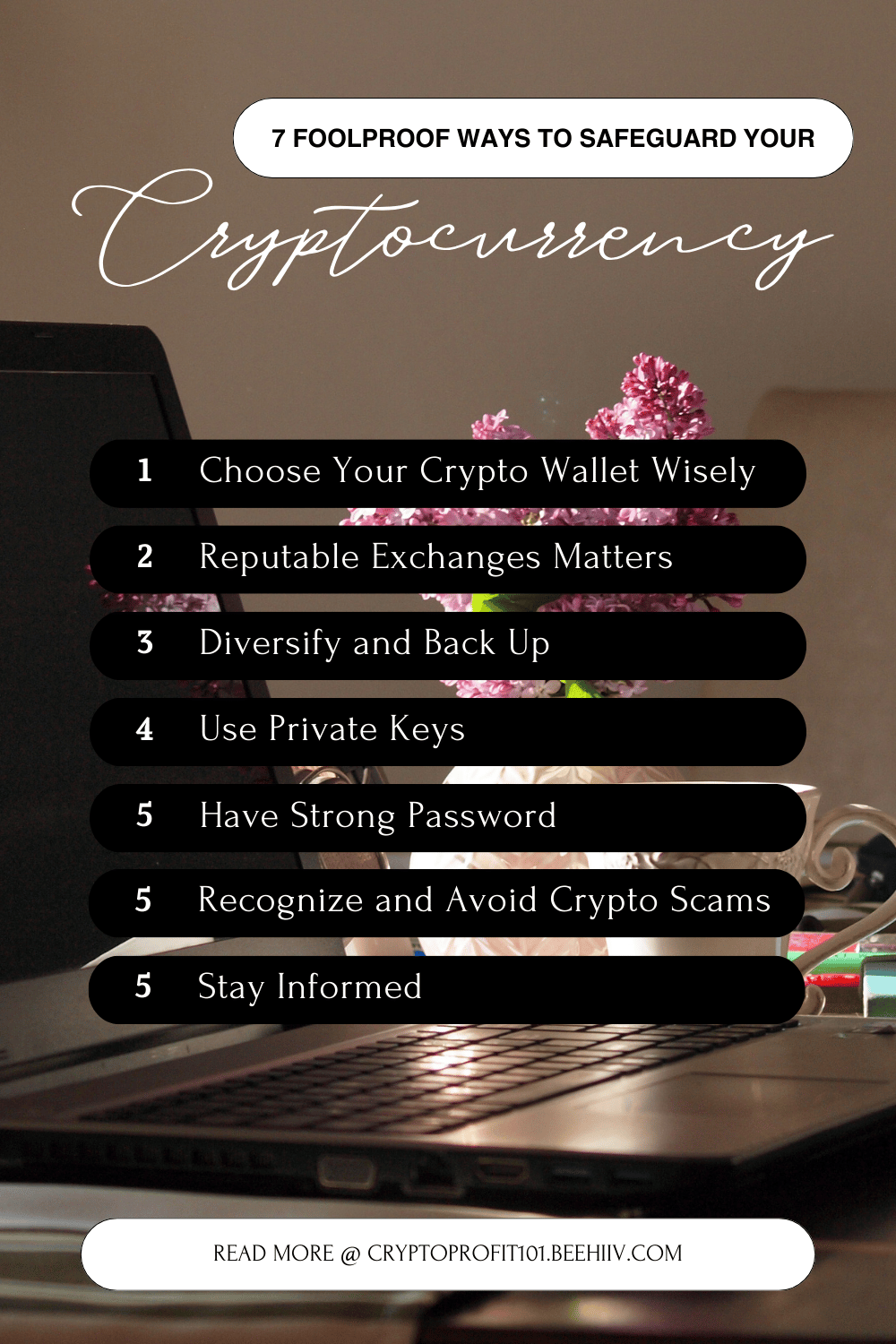

- 7 Foolproof Ways to Safeguard Your Cryptocurrency

7 Foolproof Ways to Safeguard Your Cryptocurrency

Don't Let Your Crypto Dreams Turn into Dust

Are you part of the 76% of adults under 45 curious about investing but paralyzed by the fear of the complex crypto market? Let’s change that today.

Are you a beginner investor, eager to dive into the world of cryptocurrency but held back by the fear of the unknown? You’re not alone. Cryptocurrency offers a unique blend of risks and rewards. On one hand, its technological underpinnings promise a future where financial transactions are more inclusive, secure, and transparent. On the other, stories of scams, volatile markets, and the opaque jargon of blockchain technology can intimidate even the most tech-savvy investors among us. If you’re reading this, you’re likely seeking to understand how to safeguard your digital gold in a market that never sleeps. Well, you’re in the right place.

Introduction

Did you know that as of 2021, there were over 5,000 cryptocurrencies being traded worldwide? That’s a lot of opportunities for investment! But with great opportunity comes great responsibility. The responsibility to keep your investments safe. This blog post will arm you with 7 foolproof strategies to safeguard your cryptocurrency. So, let’s dive in!

1. Choosing Your Crypto Wallet Wisely: Your Crypto’s Personal Bodyguard

Think of your wallet as your crypto's home. There are two main types: hot wallets and cold wallets.

Hot wallets, like apps on your phone, are convenient for everyday transactions but can be more vulnerable to hacking.

Cold wallets, like USB sticks or even physical pieces of paper, store your crypto offline, offering maximum security but with less accessibility. Cold wallet isn’t connected to the internet, making it less vulnerable to hacks

Ledger Nano S: This is not your thumb drive. It is a cold wallet.

Imagine your hot wallet as your everyday purse you carry for quick purchases, while your cold wallet is like a deposit box at the bank, holding your larger savings under secure lock and key. Choose the one that best suits your needs and rest easy knowing your crypto is safe.

2. Reputable Exchanges Matters: Don’t Compromise on Quality

If you plan to actively trade cryptocurrencies, you'll need a reputable exchange. Look for exchanges with strong security features like two-factor authentication (2FA) and a proven track record of keeping user funds safe.

Two-factor authentication (2FA) is like adding a double-door entry to your digital vault. It’s a simple step that requires not just your password but a unique code accessible only to you, typically sent to your mobile device. It’s a no-brainer layer of protection that can make all the difference.

Think of it like choosing a reliable bank – you wouldn't trust your money with just anyone, would you?

3. Diversification: Don’t Put All Your Eggs in One Basket

Just as you wouldn’t put all your eggs in one basket, don’t store all your crypto in one place. Diversifying the storage of your cryptocurrencies can help mitigate risk. Consider using a combination of hot wallets (online) and cold wallets (offline) for optimal security.

Also, regularly back up your wallets to protect your crypto from unexpected mishaps like computer failures or data loss. Store your backups in multiple locations for added security.

4. Private Keys: Keep Your Investments Under Wraps

Imagine your crypto is a treasure chest. The private key is the secret combination that unlocks it. It's crucial to keep your private key safe, because whoever has it controls your crypto. Some wallets store your private key for you, while others require you to manage it yourself.

Here's the catch: If you lose your private key, you lose access to your crypto forever. It's like losing the only key to your treasure chest – your riches become inaccessible.

Better be safe than sorry: Some investors use stainless steel to engrave their private keys.

In a world buzzing with technology, sometimes going old school is your best bet. Keeping your private key online can be risky. Writing down your private keys on a piece of paper and storing it in a safe place can be surprisingly secure. Just like burying a treasure map, make sure it’s hidden well and accessible only to you (or trusted allies).

5. Strong Passwords: The First Line of Defense

A weak password is a hacker's dream! Your password is the first line of defense against unauthorized access to your wallet. Make sure it’s strong and unique. Consider using a password manager to generate and store your passwords.

Here's how to craft a password that's more like a high-tech security system:

Length is Your Friend: Aim for passwords at least 15 characters long. The longer, the better!

Mix it Up: Combine uppercase and lowercase letters, numbers, and symbols to create a complex password that's difficult to guess. Think of it like a delicious stir-fry – the more ingredients you throw in, the harder it is to decipher the flavor.

Uniqueness is Key: Don't reuse the same password for multiple accounts. A hacker cracking one password could gain access to all your crypto holdings! Imagine having the same key for all your locks – a security nightmare!

6. Recognizing and Avoiding Crypto Scams: Use Simple Common Sense

The crypto world, unfortunately, attracts its share of bad actors. Here's how to identify and avoid common scams:

Get-Rich-Quick Schemes: If something sounds too good to be true, it probably is. Avoid any investment promising astronomical returns with little risk. Remember, steady growth is usually a safer bet than a moonshot.

Phishing Attacks: Be wary of emails or messages urging you to click on suspicious links or download attachments. These could be attempts to steal your login credentials or private keys. Think of them like phishing lures – they might look tempting, but they're designed to steal your valuable crypto catch!

Fake Websites and Apps: Always double-check website URLs before logging in and download apps only from trusted sources like official app stores. Imagine a fake online store – it might look real, but your purchase could end up disappearing into thin air.

Unrealistic Investment Advice: Don't blindly follow online influencers or social media gurus dispensing crypto advice. Do your own research and understand the risks before investing.

7. Stay Informed: Knowledge is Power

The crypto space is constantly evolving. Here are some ways to stay informed:

Follow Reputable News Sources: Subscribe to newsletters or websites dedicated to providing reliable crypto news and analysis.

Join Online Communities: Connect with other crypto enthusiasts in forums or online groups to learn from their experiences and share knowledge.

Read Crypto Blogs: Blogs like this one offer valuable insights and explanations for beginners.

Remember, the more you learn, the better equipped you'll be to make informed investment decisions and navigate the ever-changing crypto landscape.

Ready to join the exciting world of crypto with confidence? Subscribe to our newsletter, "Crypto Profit 101," for more valuable insights, security tips, and market updates. We'll be your guide on this crypto journey!

Also, share this post with your friends and family who might be interested in learning more about crypto. Empowering others with knowledge is a great way to build a secure and informed crypto community together.

Conclusion

Investing in cryptocurrency doesn’t have to be a leap into the unknown. With these seven strategies, you can navigate the crypto market with confidence. Remember, the key to successful investing is education. So, keep learning, stay curious, and most importantly, stay safe!

Start Taking Action: Your Journey to Secure Crypto Ownership

Now that you're armed with this knowledge, you're ready to take action! Here are some steps to get you started:

Choose a reputable crypto exchange or wallet provider: Do your research and pick a platform with a strong security record.

Set up strong passwords and enable 2FA: This adds an extra layer of security to your accounts.

Decide on a wallet strategy: Choose between a hot wallet for easy access or a cold wallet for maximum security, depending on your needs.

Secure your private key: If you manage your own private key, store it offline on a piece of paper or metal plate.

Start small and learn as you go: Don't invest more than you can afford to lose, and gradually increase your crypto holdings as you gain experience.

Use common sense everyday: As simple as it sounds, it is not as universally practiced as you think.

Summary: Your Crypto Security Cheat Sheet

Store your crypto in a secure wallet: Choose between a hot wallet for convenience or a cold wallet for maximum security.

Diversify your crypto storage: Back up your wallet regularly too.

Use strong passwords and 2FA: This makes it harder for hackers to steal your crypto.

Keep your private key safe: This is the key to accessing your crypto, so store it offline securely.

Beware of scams: Don't fall for get-rich-quick schemes, phishing attacks, or fake websites.

Stay informed: Follow reputable news sources and communities to stay updated on the crypto market.

Final Thought

The world of cryptocurrencies is exciting and full of potential. By following these security best practices, you can confidently explore this new frontier and turn your crypto dreams into a secure reality. Remember, knowledge is power, and with the right approach, you can be a successful and secure crypto investor!

Glossary of Terms

Cryptocurrency (Crypto): A digital asset designed to work as a medium of exchange that uses cryptography for security. (e.g., Bitcoin, Litecoin)

CoinMarketCap: A website that tracks the price and performance of various cryptocurrencies.

Wallet: A digital application or hardware device that stores your cryptocurrency.

Hot Wallet: A crypto wallet connected to the internet, allowing for easy access and transactions.

Cold Wallet: A crypto wallet stored offline, on a USB stick or even a piece of paper, offering maximum security.

Private Key: A unique code that grants access to your cryptocurrency holdings.

Two-Factor Authentication (2FA): An extra security layer that requires a second verification step, like a code from your phone, to log in to your account.

Phishing Attack: An attempt to trick someone into revealing sensitive information, like passwords or private keys, by disguising themselves as a trustworthy source.

Reply