- Crypto Profit 101

- Posts

- 2 Reasons You Will Regret Selling Your Bitcoin—Whales Just Moved $10B

2 Reasons You Will Regret Selling Your Bitcoin—Whales Just Moved $10B

Don’t Make a Move Before You Read This!

Alright, let's get real. Over the past few days, I’ve questioned whether I should even hold onto my Bitcoin.

Why?

Because the noise from friends who think crypto’s a joke got in my head more than I’d like to admit.

Maybe you’re feeling the same—wondering if this article is just another one telling you to “HODL” when you're unsure.

Trust me, I get it. But here’s the deal: I’ve been tracking the real players—the whales—and what I’ve found is going to flip your perspective upside down.

In this article, I’m not feeding you hype.

We’re going to break down exactly what whales are doing, how they’re quietly stacking up Bitcoin while everyone else panics, and what you can learn from their moves.

This isn’t another generic hold-your-crypto spiel—this is a real, data-backed analysis to help you make sharp, decisive moves in the market.

So stick around until the end.

You’ll leave with a no-BS understanding of what’s really happening in this manipulated market and how you can outsmart the crowd.

Ready to get into it? Let’s go.

Whales Are Accumulating Bitcoin Quietly and What You Should Do

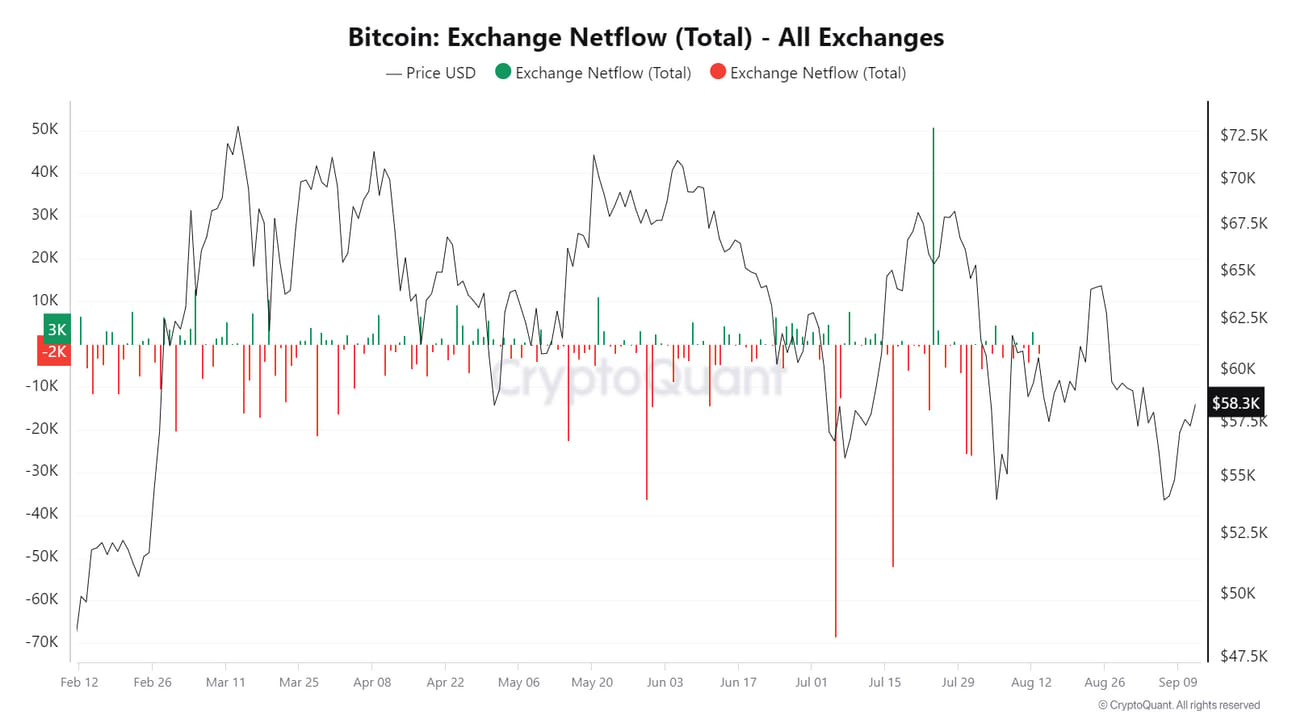

Over the last six months, the whales—those big players who actually control this market—have quietly added over $10.27 billion worth of Bitcoin to their wallets.

There are much more outflow from the exchanges (red bar) than inflow into the exchanges (green bar). Source: Cryptoquant

That’s right, while everyone else is panicking about dips, these guys, who hold between 100 and 1,000 BTC each, now control about 20% of all Bitcoin out there.

What does this mean for you? Wake up. These whales aren’t sweating the market dips, and neither should you.

While short-term holders are selling at the slightest dip, the whales are playing the long game. They’re yanking Bitcoin off exchanges and stockpiling it, knowing that when the supply dries up, prices are going to rocket.

If you’re selling right now, you’re playing right into their hands.

Follow the big money. Whales aren’t selling—and if you’re thinking about cashing out because your friends are doubting crypto, you’re on the wrong side of the game.

Bitcoin Surpassed $57,000 – Why It Matters

Bitcoin just crossed $57,000, and stayed there for 3 straight days. This isn’t just some random uptick—it’s a sign that things are moving.

Analysts are already seeing 3 months of upward momentum, and while everyone’s waiting for some magical “bull cycle,” the smart money is already positioned.

Plus, the numbers don’t lie. The RSI (Relative Strength Index) is showing serious market momentum.

More people are buying than selling, and the whales aren’t letting go of their BTC.

This isn’t a coincidence—it’s a coordinated play. While everyone’s distracted by the noise, the big players are sitting tight, waiting for the next surge.

What You Need to Take Note Of

Whale Activity: The whales are stacking BTC because they know something you don’t. They’re not here for a quick flip; they’re positioning themselves for a serious move.

Watch them closely, because their moves speak louder than any headline.Market Momentum: Bitcoin breaking $57,000 and staying there isn’t a fluke. The momentum is strong, and the indicators are there for anyone who’s paying attention.

Forget what you hear on the news—this is the real signal.Be Nimble: Sure, whales can think long-term because they can afford to. But if you’re a trader or you don’t have the money to ride through violatily, you need to be more nimble.

This market can flip on its head in 3 months, and your goal isn’t to sit back and wait. Yes, it is looking to turn bullish right now, but don’t get complacent.

Stay sharp, because things can change fast, and you need to be ready to pivot when they do.

Markets move fast, and if you’re not nimble, you’re losing out.

In crypto, timing is everything—whales can afford to sit back, but if you want to profit, you need to be quick on your feet.

I found this Cryptocurrency Trading for Beginners course is honestly a game-changer if you’re trying to stay quick and nimble in this wild market.

It’ll give you the tools to react fast when things move, so you’re not left behind. Trust me, it’s worth checking out. They have 54,000+ students and 4.4 out of 5 ratings.

Timing is everything, and this could be the edge you need this season. Here’s the link to check it out.

Conclusion: What Should You Do?

Here’s the bottom line—if you’re new to the crypto game, stop thinking like the masses.

The whales aren’t selling, and they’re definitely not panicking over every little dip. They’re positioning for big gains, and if you want to make real money, you need to think like them.

Stop worrying about what your friends or the media say. Follow the real signals: whale activity, market momentum, and short-term trends.

And if you’re tired of the fluff and want real insights that cut through the noise, subscribe to Crypto Profit 101.

I’m not here to sugarcoat anything—I’m here to show you what’s really going on, before it’s too late.

Reply